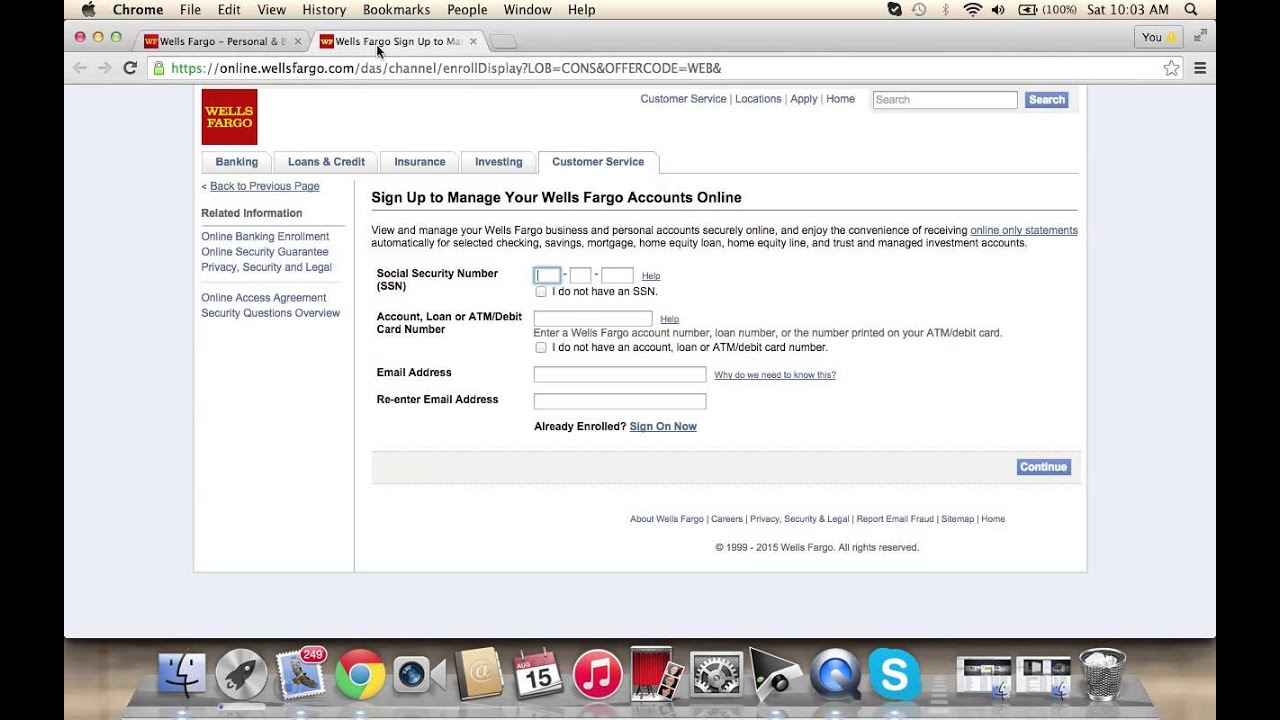

Are the primary account owner and 24 years of age or younger.Make an automatic transfer of $1 or more each business day from a linked Wells Fargo checking account.Make an automatic transfer of $25 or more from a linked Wells Fargo checking account.Have at least one “Save As You Go” automatic $1 transfer from a linked Wells Fargo checking account when you complete a debit card purchase or bill pay transaction.Wells Fargo Way2Save® Savings has a $5 monthly service fee, but it’s waivable if you meet one of the following monthly requirements: Wells Fargo has two primary savings accounts: Way2Save and Platinum Savings.īoth accounts require a $25 minimum initial deposit. The account’s monthly service fee is the highest among all of the bank’s checking accounts, but it’s waived for customers who maintain balances totaling $250,000 or more across Wells Fargo deposit and investment accounts, including checking, savings, CDs, annuities and brokerage accounts. Interest rate discounts on select loan products.Personalized 24/7 phone support from the bank’s Premier Banking team.Wells Fargo Premier Checking is an interest-bearing (0.25% to 0.50% APY depending on balance) account featuring what Wells Fargo describes as its “highest level of relationship banking benefits and perks.” They include: It’s waived for customers who keep $20,000 or more in linked Wells Fargo deposit and investment accounts, such as checking, savings, CD and brokerage accounts. Prime Checking accounts come with a $25 monthly service fee. Some reimbursements of ATM fees charged by machines not owned by Wells Fargo.Fee-free cashier’s checks and money orders.Prime Checking is an interest-bearing (0.05% to 0.10% APY depending on balance) account that offers a long list of perks and discounts. This checkless account is available for anyone to open, but its $5 monthly fee is waived only for primary account holders ages 13 to 24. Wells Fargo Clear Access Banking℠ is a digital checking account. Are a primary account owner 17 to 24 years old.Have a linked Wells Fargo Campus ATM Card or Campus Affinity Debit Card.Have $500 or more in total qualifying direct deposits each statement period.The account features a $10 monthly service fee, which is waived if you meet one of the following each statement period: Wells Fargo Everyday Checking is a basic checking account with a complimentary debit card and check-writing privileges. There are four different accounts available, each requiring a $25 minimum initial deposit. Wells Fargo customers have several options when it comes to checking accounts. This Wells Fargo review will help you determine if these products fit your needs.

Whether you’re looking to open a checking, savings or certificate of deposit (CD) account, the bank has options for you. Wells Fargo offers a variety of banking products for individuals at any stage of life.

0 kommentar(er)

0 kommentar(er)